A bill filed in the Kentucky Senate this week aims to put a halt to rising Kentucky vehicle taxes.

Senate Bill 75 would direct the Department of Revenue to use last year’s vehicle property values to determine car tax rates in 2022 and 2023. The bill was filed Monday by Sen. Jimmy Higdon, R-Lebanon.

Car property taxes are determined by the value of the car. Used car values have skyrocketed in the past year due to supply chain hiccups, which has slowed the production of new cars.

The Kentucky constitution says the state has to set values based on fair cash value. A Kentucky statute also says those valuations must come from a standard manual such as NADA or Kelley Blue Book. Values are not set by the Governor’s Office, as some social media posts about the issue have alluded to.

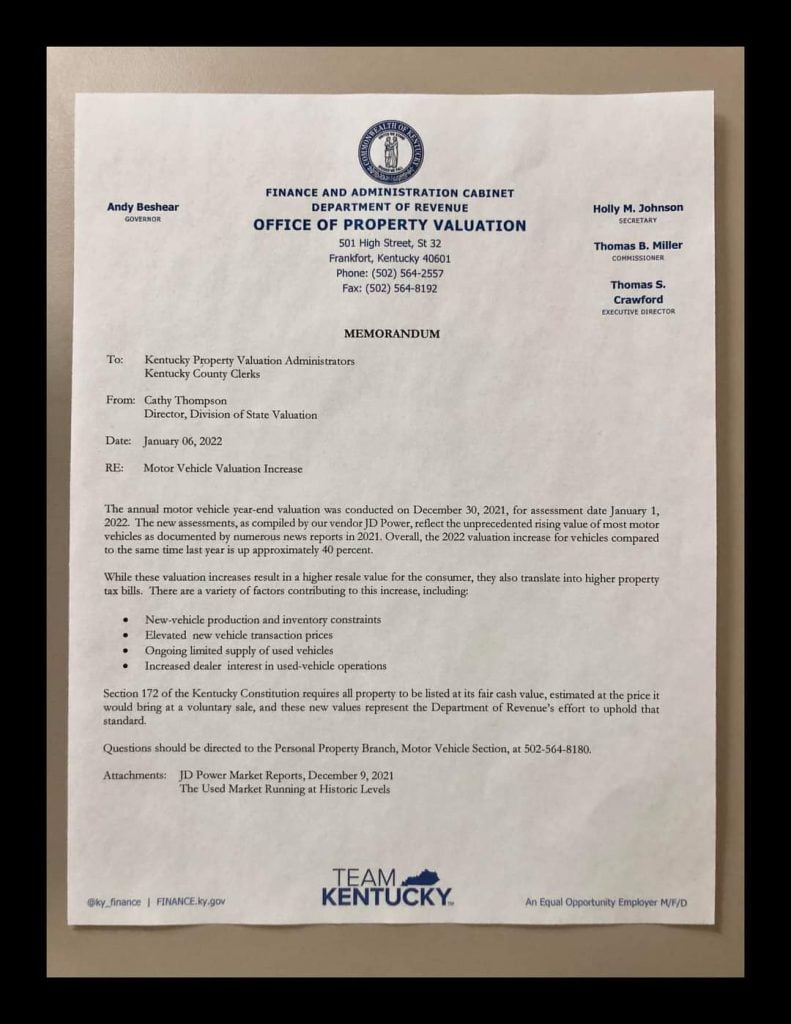

County PVAs and County Clerks were recently sent this letter, which was widely circulated on social media. The letter from the Kentucky Department of Revenue indicates that used car values have gone up as much as 40 percent.